If you have received a letter from us, there is an undisputed and existing claim against you. This is not a problem and can happen.

Now it is important that you act and settle the claim to avoid further costs. Please transfer us the letter.

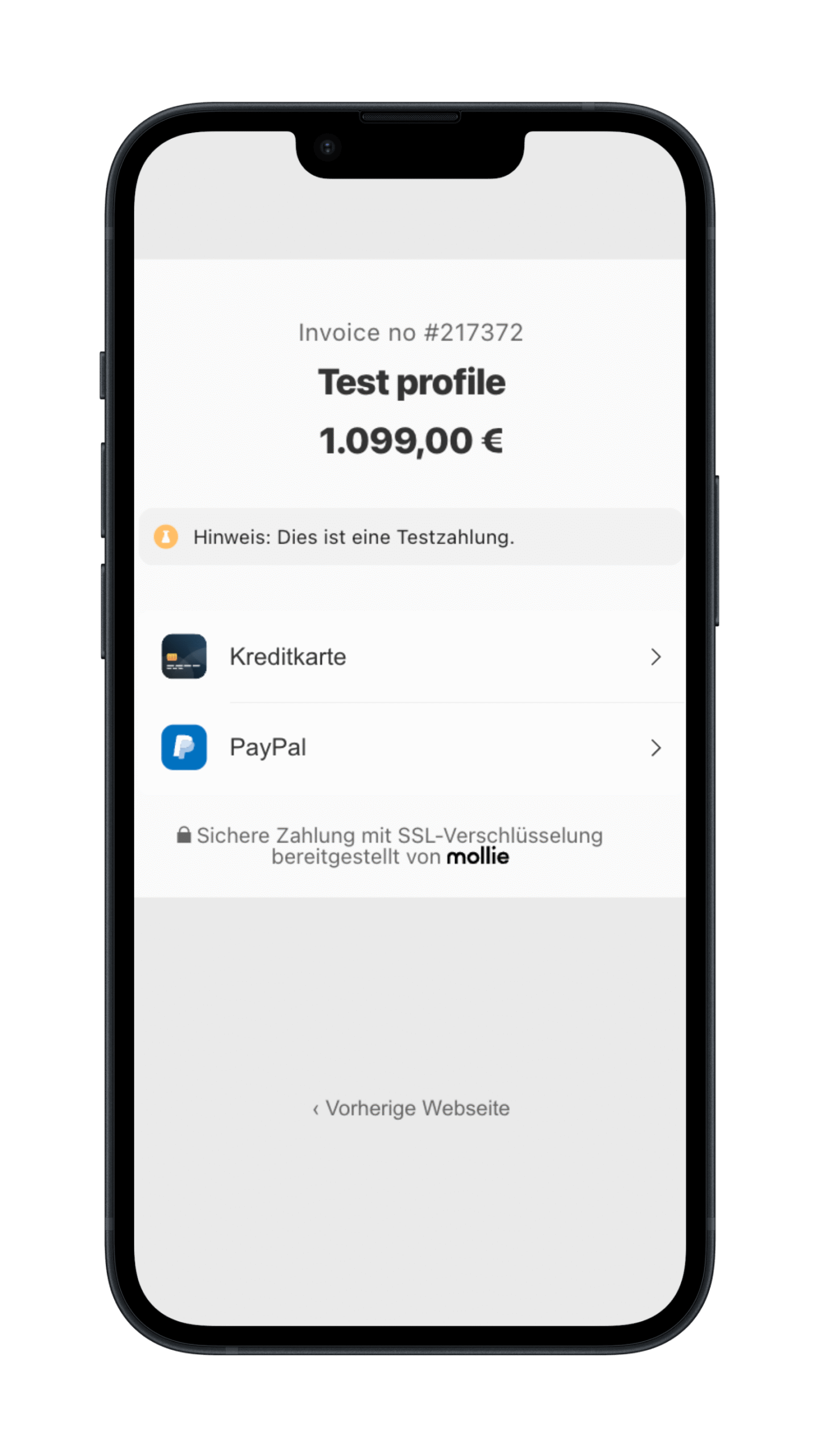

Scan the QR code on the invoice and pay directly online in the debtor dashboard.

Divide your payment into monthly installments depending on availability and set up a direct debit mandate.

Your liabilities are displayed transparently for you in our dashboard.

To pay your invoice, all you have to do is scan the QR code at the top of the invoice sent to you with your cell phone. You will then be redirected to the payment portal and can choose from one of the various payment methods.

If you do not have a cell phone or cannot scan the QR code, you can use a conventional bank transfer. Please be sure to write the file reference / invoice number (e.g. #FI-2023-000001) in the reference field so that we can allocate your payment.

Send a classic bank transfer

Pay quickly and conveniently via PayPal

Fast payment by credit card

Debit recurring invoices without any problems

In the event of non-payment, there is an initial threat of further default costs and the possibility of dunning proceedings being opened against you. Further steps may result in a negative Schufa entry. Your account or your wages or salary can also be seized as part of enforcement proceedings.

Do you have difficulties paying the bill? This is not a problem either. You can find other customized solutions under the payment method after opening the invoice. If you need further individual advice, please describe your personal problem in the service portal.

If you have received a debt collection letter from us, you probably have a lot of questions. To help you as a first step, we have compiled the most frequently asked questions. Your question is not listed? We will be happy to help you Service portal more

Either with a reference number on the website directly online with the various payment service providers offered there such as: Paypal, Klarna, by bank transfer, direct debit, Mastercard, immediately.as well as Apple Pay.

If you have received a letter from us, you must direct the payment to Fortis. Once we have been instructed to assert the claim against you, we alone are responsible for collecting the claim. If you make a payment to the creditor, you run the risk that you will not be released from your payment debt and that the debt collection measures against you will be continued due to the inability to allocate the payment.

Your creditor has commissioned us because you have not paid for a service or goods despite an invoice and a reminder. In accordance with §§ 280, 286 BGB (German Civil Code), the creditor can claim the costs incurred by your non-payment in addition to the original claim (principal claim) and the statutory default interest up to the amount specified in § 4 Para. 5 RDGEG

(Introductory Act to the Legal Services Act) as compensation for damages at the

debtor. However, the creditor can also pass the enforcement on to a debt collection agency. The collection of the aforementioned receivables is then part of the debt collection agency's mandate and can only be enforced by the debt collection agency. Therefore

In addition to the principal claim, you are now also obliged to pay interest on arrears and the

to settle the claim for damages incurred by commissioning the debt collection company (collection costs).

The information concerning your person corresponds to the information provided by the creditor at the time of the assignment. If you consider the data provided to be incorrect and you are not the debtor of the claim asserted, in particular if you have been the victim of identity theft, please inform us immediately on our website. To do so, please log in with your file number and send us a message.

We offer you to pay the claim in installments or by instalments according to your financial situation.

to settle the claim. In our letter you have received an enclosed

installment payment agreement. You can fill it out and send it back to us or you can contact us via the Service portal contact us. You can also submit an application for payment in installments via the service portal by ticking the box next to Application for payment in installments / deferral and describing your request and your financial possibilities for payment in more detail. We will then get back to you and will be happy to help you.

First of all, you will of course be given time to respond to our letter. If we are still unable to reach you after further attempts to contact you or if you do not demonstrate a willingness to pay, we will initiate dunning proceedings against you. The sooner you pay, the lower the collection costs will be for you. In addition to legal proceedings, a negative Schufa entry is also possible, which should also be avoided as a matter of urgency. This is because it classifies you as unworthy of credit. As a result, you are no longer free to make financial decisions, as your person will be checked in everyday transactions such as applying for a rental apartment or taking out a mobile phone or internet contract. You also run the risk of having to provide the bailiff with comprehensive information about your assets so that he can

can decide whether and where he can seize something from you. In the next step, if you are absent from the bailiff's appointment without excuse, the creditor can, as a last resort, apply for an arrest warrant to be issued against you. In general, you are therefore urgently advised to pay if you have a claim in order to avoid negative consequences.